There is absolutely no one proportions suits every form of lending company for everyone. But not, with a bit of looking around you’ll find the correct one to you.

To shop for https://www.paydayloansconnecticut.com/suffield-depot/ a property shall be the biggest buy your actually ever build that you know, so you want to make certain that you work at a beneficial a beneficial lending company. Besides do you wish to provide you with the newest greatest pricing out there, however would also like with the intention that your contract is right for you, your financial updates, along with your existence.

Evaluating mortgages is easier than before today. Whilst you can also be believe in home financing advisor or agent, you may carry out the legwork your self thanks to the let out-of on line research systems that allow you contrast pricing. Yet not, it will nevertheless be daunting, that is where this informative guide is available in. Listed here is our very own accept a knowledgeable mortgage brokers in Canada to have a number of other home loan things and requirements.

Ideal lending company having reasonable fixed costs: Meridian Credit Commitment

One of the largest discussions regarding mortgages try whether to squeeze into a predetermined- otherwise adjustable-rates home loan. Discover benefits and drawbacks in order to both, but those who like repaired financial prices always get it done since the they are concerned about affordability. They worry about this new volatility of your markets and wish to greatest protect themselves.

Obviously, element of protecting on your own being aware of affordability mode your must make sure you get the best rates. At all, you’re closed in for a few years.

Fixed-price mortgages are very different regarding lender and you may lender along with your very own personal financial situation will gamble an enormous role throughout the kind of pricing you can aquire. Yet not, if you are looking for the best lending company to have reduced repaired rates upcoming check Meridian Credit Connection.

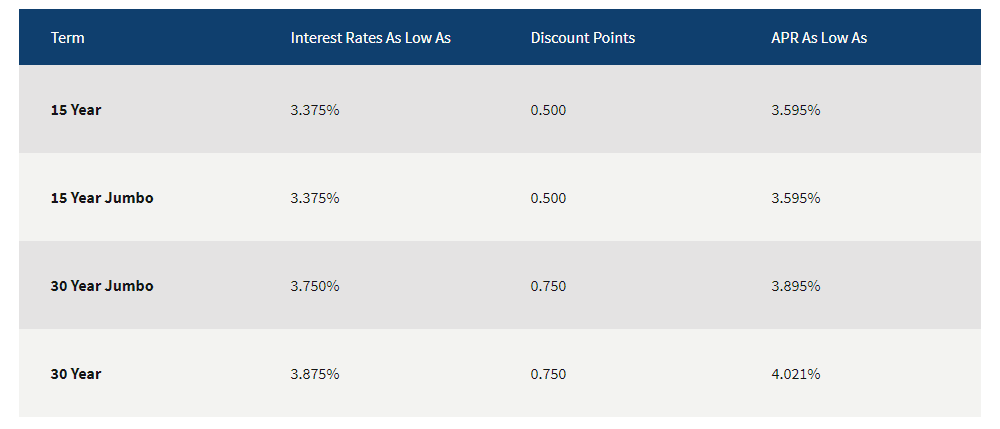

Meridian Borrowing Union try Canada’s 2nd-largest borrowing from the bank union. They are situated in Ontario however, give services, including mortgage loans, around the Canada (except for on the province out of Quebec). Meridian Borrowing Partnership has the benefit of a few of the most aggressive repaired costs in the market. At the time this information is penned () the current terminology and pricing given by Meridian Borrowing from the bank Commitment was below:

- Pre-acceptance that have a great 90-date rate ensure

- Forget about an installment choice (one month’s mortgage repayment a-year)

- Flexible homeloan payment possibilities (a week, biweekly, month-to-month, bi-month-to-month, or expidited weekly and you can biweekly percentage bundle options)

- Money back program (3% – 5% out of home loan dominating available in advance so you can obtain)

- choice to shell out your own financial back less

Competitive fixed prices and you will a whole bunch of benefits and you can advantages generate Meridian Credit Partnership worth considering when searching for good mortgage lender for the Canada.

Look at your credit history before hitting the business

Good credit is important to get a minimal financial price, and you may web sites such as for example Borrowell makes it possible to look at your credit history at no cost. Do not wade to your housing industry lacking the knowledge of where you stand.

Most useful home loan company for folks who need to lower quick: Lime

No one wants to need to pay more they should. Yet not, if you possibly could lower the financial faster than the consented-through to fee rate, you then will be. Which is while their package allow you to.

A lot of the signed mortgages available to you enjoys tight founded-when you look at the stipulations about prepaying your home loan and exactly how far more you is also establish yearly. It is difficult if you possess the financing to pay it well more readily but don’t want to be concerned about becoming penalized to own overpaying. But not, certain mortgage brokers allow you to repay their signed home loan less as opposed to others. One of the finest lenders because of it are Lime.